FSU, Capital Stacks, Waterfalls & ACC Exit Fees

Making (some) sense of the redactions in FSU's Project Osceola FOIA Disclosure

Thank you FSU for the waterfall references, even if they are just nested in a heavily redacted Excel spreadsheet. Watch the video here and then sing or hum along while you read the article. Note to non-FSU fans: Your school is likely engaged in this same exercise behind the scenes. Finding new revenue is not driven by conference exit fees alone.

Deciphering FSU’s Project Osceola’s Redactions

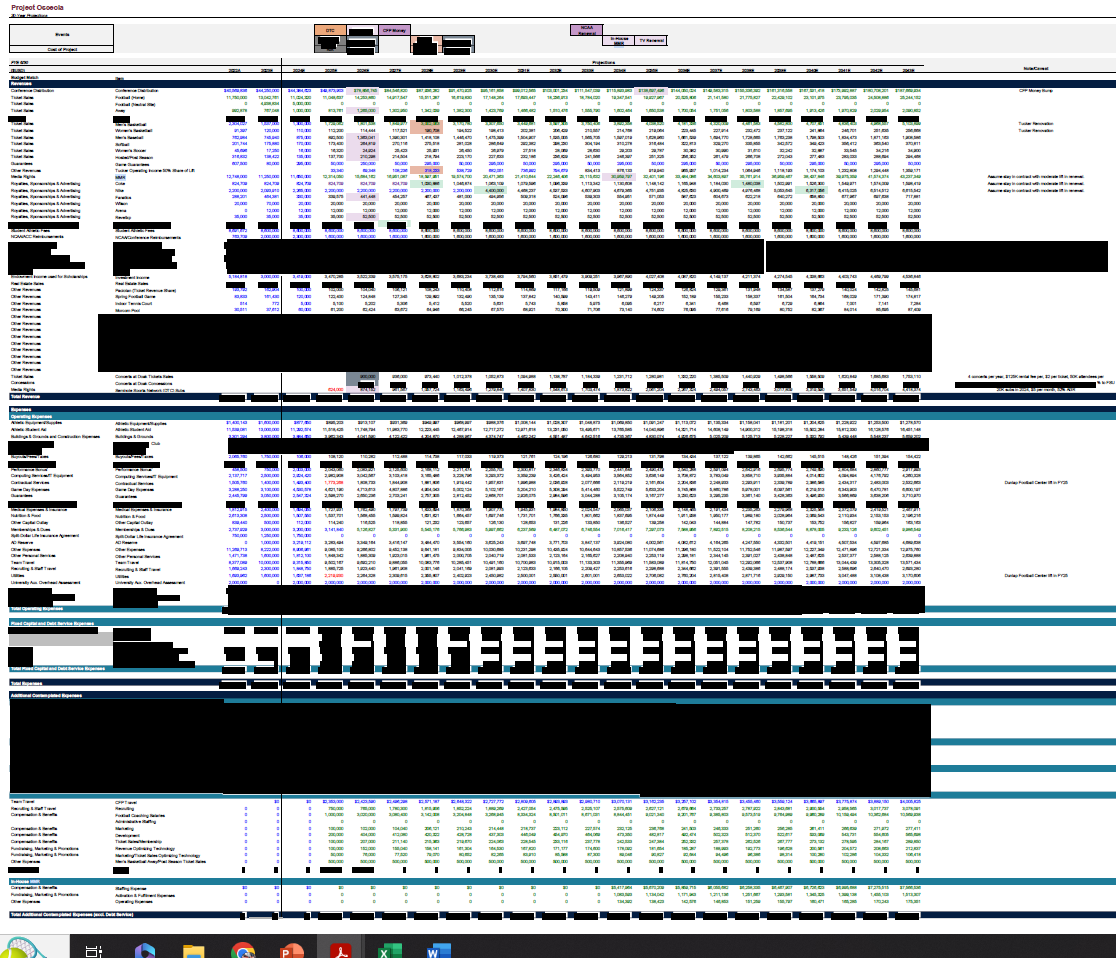

The FOIA Documents released to Sportico, myself, and others contain a massive spreadsheet that is fed by 16 other spreadsheets. Each of those feeder spreadsheets is heavily redacted, or in some cases completely blacked out.

Filling in the blanks to find the revenue sources that FSU will use to pay any ACC exit fees requires some context, patience, and a few cups of coffee.

First, the context. At the heart of Project Osceola are joint ventures with one or more private parties to maximize sports-related revenues. The goal of the project is to raise hundreds of millions of dollars to pay for the exit from the ACC. So, references in the documents to capital stacks, waterfalls, splits, and revenue “lifts” provide clues as to what new revenue is behind the black cells.

Joint Venture Jargon

A capital stack is simply a numerical depiction of cash and debt used to fund an activity. When you buy a home, your capital stack is the down payment and the mortgage. The mortgage is on top of the stack as it gets paid first (after basic household expenses of course), and your down payment is on the bottom (gets paid back when you sell your home). If you take on a home improvement loan, that obligation rests in the middle between the mortgage and down payment. At the bottom of Florida State’s capital stack is the equity FSU has in its current assets and any buy-in (cash purchase) from a private investor to become a joint-venture owner of those assets. At the top of the stack is bond debt issued by the university, and in the middle, there may be debt loaned to the joint venture by the private investor (sometimes referred to as Mezzanine Debt). The capital stack numbers are redacted, but now you know what you are missing.

A waterfall refers to 1) something you shouldn’t chase, or 2) the order in which profits are distributed among partners. In some cases, it also includes the order in which obligations of the joint venture are paid before profit distributions. In FSU’s case, bond debt is paid first, if there is a mezzanine loan it is paid second, and then FSU and its private partners get their profits distributions last. The distribution of revenue to FSU and its private partners is likely to have multiple levels as well based on the value each provides to the venture. Each party may split the revenue flow equally at first based on their share of the investment until each receives a target return on their investment. After that return is met, the revenue flows to a second split where the private equity firm may get a higher cut because of the value it adds to the operation of the venture.

Revenue ”lifts” describe new revenue added to FSU’s coffers due to a change in operations or an investment in new facilities, equipment, or joint ventures. These revenue lifts are the product of all the various joint ventures and public investments hidden in the FOIA documents and are key to FSU’s move into the highest echelons of College Athletics. I expect every university involved in FBS division football is looking, or will look, for similar revenue lifts in their operations.

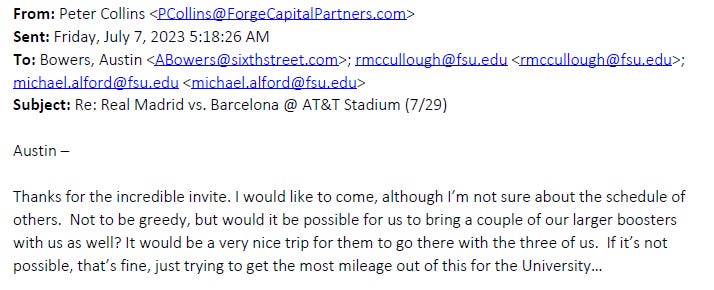

“Can I have more Tickets?” is a phrase often used during the initial meetings between Private Equity firms and clients. This is a test to see if either party is serious about a potential partnership, and if they have the status within an organization to get difficult tickets. Access to tee times at exclusive golf courses is another acceptable test.

Behind the Black Cells

Here is a summary of the biggest revenue lifts that are identified, implied, or possibly hidden in the FOIA documents along with the page number where you can find it in the FSU model (attached at the end):

Identified (unredacted) Revenue Lifts

Conference distributions:

College Football Playoff: $30 million/yr extra in 2026 and another $23 million/yr increase in 2035. (p. 14 has CFB playoff note)

Sports Data Deal: $2.0 million/yr in 2026, escalating 10%/year (p.17)

“Moderate Lift” in renewing contracts for Coke and Nike.

Coke: $206,000/yr increase in 2028

Nike: $2.2 million/yr increase in 2030 (doubles Nike’s contract)

Basketball “Seat Licenses”: $1.86 million/yr “unrestricted revenue lift” in 2025 (p. 19) based on 2,931 fans contributing $633 per seat/season above the face value of the ticket. I’m referring to this as a license. FSU calls it a per-seat contribution (PSC).

Basketball Arena Operating Income: $632,000/yr increase in 2028 (p.14)

Concerts at Football Stadium: $900,000/yr in 2026 (p. 14) Note in spreadsheet reads: Four (4) concerts per year, $125K rental fee per, $2 per ticket, 50K attendees per.

Marketing and Media Rights (MMR)

Football New Revenue: $4.5 million/yr (p. 20)

Basketball New Revenue: $2.25 million/yr (p. 20)

New Concert Sponsorships: $1.0 million/yr in 2026 (p. 20)

Subscriptions to Seminole Sports Networks in 2025: $624,000/yr (p.14) Note reads: $20K subs in 2024, $5 per month, 52% of Adjusted Gross Revenue (AGR)

Implied Revenue Lifts

Football Premium Tickets: Unknown (p. 14). There is an entire section redacted on the Football Ticketing page (p. 18) in the same location as the basketball seat licenses found on the Basketball Ticketing page (p. 19).

Premium seating for Basketball: Unknown (p. 19). There are several redacted rows below the heading “Premium Ticketing Assumptions.” This may simply be the Seat License revenue above or a new category of revenue.

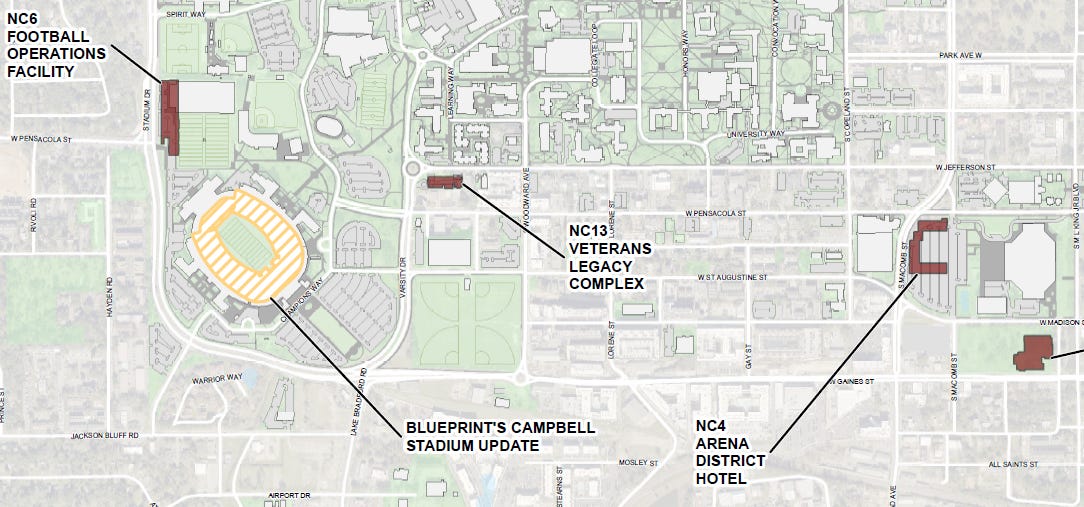

Joint Venture with Catalyst Healthcare Real Estate to build and manage $116 million Football Operations Facility: Estimated $300,000 yr ground lease (based on $3.0 million in land value/$20 per building square foot). The company has a PowerPoint presentation in the FOIA disclosures. Follow the link to their press release on the project.

Change in Concession Contract: Unknown (p. 14). All concession-related numbers are redacted in various spreadsheets.

Unspecified Real Estate Sales: Unknown (p. 14). The revenue category of “real estate sales” is included in the forecast, but the actual numbers are redacted.

Golf Course Operations: Unknown (p. 16). There is one reference to a “Golf Course Loan” in the Contributions detail.

Possible Hidden Revenue Lifts

Legacy Hall Commitments: Unknown. There is extensive discussion/email exchanges in the FOIA docs regarding large donations to FSU under their Legacy Hall program. The FSU model has a Contribution section that is entirely redacted (p. 16) which likely includes the information referred to in the emails.

On-campus Hotel Development: Unknown (near-term project identified in FSU’s Master Plan). Other campuses across the country have entered into ground leases with hotel developers and operators and captured hotel occupancy taxes generated by hotel guests. (P. 21 of FSU Campus Master Plan)

Figure 1: FSU Master Plan Exhibit with Hotel Site Designation

Notable Projected Increases in Expenses

There are a few notable increases in expenses baked into the forecast models.

Other Expenses: $50 million in 2025 and $40 million in 2026. This could be a placeholder for a contribution to the ACC Exit Fee (p. 13)

Total Football Coaching Salaries increase by $2.0 million/yr in 2026 and another $5.0 million/yr in 2031 (p. 15).

Administrative staffing increases by $485,000/yr in 2026.

In-house MMR of $6.6 million/yr in 2034. This is likely not a net increase as it brings a contracted service in-house.

Buyouts/Fees/Taxes: Redacted

Athlete Wages: Missing. No current plan for paying student-athletes.

Interpreting the Redactions: My Takeaways

Planning to Exit the ACC has other benefits: The planning process to round up the financial resources to exit the ACC began well before the discovery that the ACC’s Grant of Rights may terminate in 2027 instead of 2036. The creativity used to create a plan to pay a significant break-up fee with the ACC generated a financial plan that can now be redirected to bolstering all of FSU’s athletic programs.

FSU could engage Private Equity Partners in three distinct businesses:

FSU has already engaged Catalyst Healthcare Real Estate to help with its $116 million Football Operations Center. The details of that partnership are yet to be disclosed, but the JV was announced on January 31 by Catalyst. Click here to see their press release.

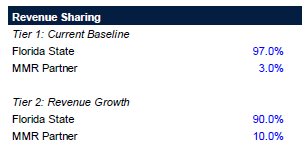

Marketing and Media Rights (MMR) is the next candidate for a joint venture. It is all but spelled out on page 20 of the model. New revenue from premium seating at football and basketball games and concert revenues are included on a single spreadsheet which includes a management fee (likely to the JV partner) and a waterfall/split of net revenues between FSU and an “MMR Partner.” The only mystery is whether the concession operations fall to this JV or another partner.

The third joint venture is highly speculative but could involve a new hotel development by the arena. If that is in the works, FSU has done an outstanding job with their redactions.

Most FBS schools should stick to the rivers and lakes they are used to. FSU has tremendous resources to shepherd for the benefit of its athletic programs. Excluding the MMR Joint Revenue, the model contains over $30 million in new revenue and the university has existing cash flow to issue over $500 million in bonds. As CFB moves to a complete professionalization of the sport, most FBS schools should consider right-sizing their athletic departments, rather than attempting to raise funds to compete with the wealthiest 10% to 20% of the current FBS programs. I’ve got more to say on this last point, but that deserves a separate post.

Take a look for yourself

You can search the PDF of the Project Osceola model (below) using the terms above to see the revenue lift for the items that were identified or suggested above. Other suggested items are identified in the due diligence trackers, PPT presentations, and emails. You can see all of those documents in a previous post.