Florida State's Project Osceola FOIA Docs

Is the Seminoles football program seeing a doctor? Six takeaways from this FOIA release

As a preface to my comments on this tranche of documents, I do not believe funding from Project Osceola is the primary solution to pay FSU’s exit fee of $400 million (or more) from the ACC. I’ll have an article detailing the more likely source in the next few days.

After Sportico published their article on Project Osceola I made a simple public records request to FSU: give me what they got. Public records requests can take months to receive, so I hoped for a quick turnaround. I was not disappointed. In a few days, I had my documents. Those documents are provided in full at the end of this article. Read them for yourself and let me know if you find something I missed.

Here are six things I found of note in the FOIA documents.

1. Marry a Doctor?

In another generation, this was common advice to find financial security. I followed it. My wife earned her doctorate in physical therapy during our marriage. It’s solid advice.

Is FSU’s football program following in my footsteps?

It may be a red herring, but on the third pass through FSU’s records I noted the footer on this otherwise humorous slide:

Note the logo at the bottom. Catalyst Healthcare and Real Estate. This footer, combined with the completely redacted PowerPoint presentation from KPMG Healthcare Strategy (full presentation of blank slides attached below) got me thinking about my case study of another university medical system. That case study was published last year in the Journal of Urban Affairs and used public records to unveil the financial strength of the UC Davis medical system. The subject of that case study is a campus expansion project that will cost $1.0 billion and generate approximately $90 million in excess revenue for UC Davis.

Project Osceola’s objective is to raise money for FSU’s exit from the ACC and compete with other national college football programs. One way to meet this objective could be to attach themselves financially to a strong medical system. In the UC Davis case, the University parlayed land donated by the State of California into a ground lease with a third party that wanted to be proximate to the research conducted by the University’s medical system. UC Davis then turned to the City of Sacramento to grab a significant public subsidy for the private project - marketed as an “Innovation Center.”

The heavily redacted cash flow statements disclosed by FSU may have revenue from a partnership with FSU’s medical system. Watch for this in future reports.

2. Big Jumps in Revenue and Expenses Projected

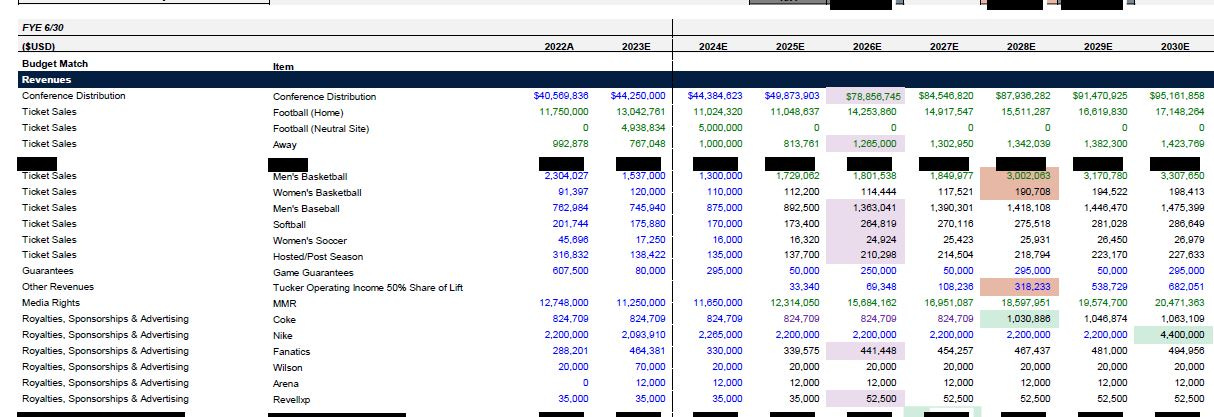

I scanned the cash flow projections for notable increases. The biggest increase in revenues is under “Conference Distribution” (second to last line) which reveals a change in 2022 Actuals to 2026 Estimated of $38.3 million (78.9-40.6). This could be CFB Playoff revenue or a higher distribution from a new conference.

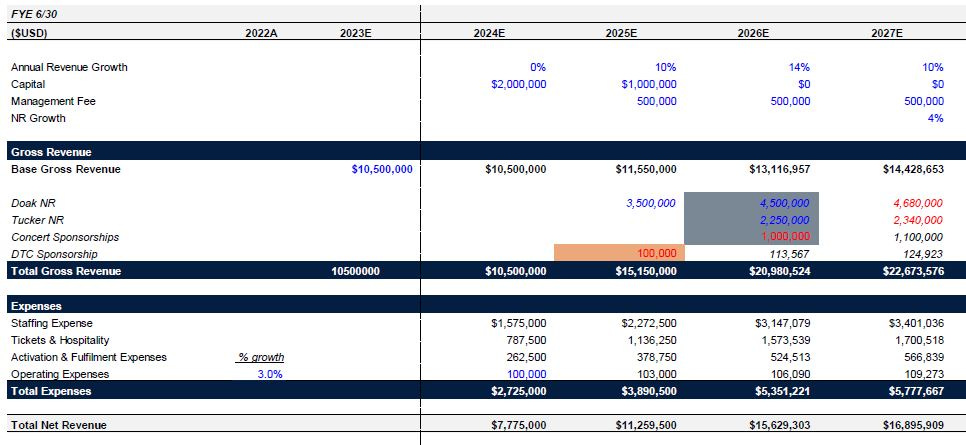

In another spreadsheet (below), FSU focuses on “New Revenue.” In this table, note the “Management Fee.” This is a sign that a third party, like a private equity group, could be compensated for managing some aspect of the Football program’s revenue-generating activities. This “Fee” is typically above and beyond actual management expenses (employee salaries, supplies, etc.). Also note the appearance of “Concert Sponsorships.” This is an activity private equity firms have exploited in their acquisition of minor-league baseball teams. The plan may be for a third-party manager to engage a concert promoter to maximize the use of FSU’s facilities. The cells were highlighted by FSU or their financial advisors. Translating some acronyms: Doak NR is new revenue from the Football Stadium and Tucker NR is new revenue from FSU’s on-campus civic center.

The focus on new revenue in this spreadsheet is a necessary step in determining how that new revenue is split between the university and any third-party partners or investors. There is a reference in the documents to a “waterfall” which is private equity speak for distribution calculations. The new revenue (which I assume to be profit) is typically split equally based on each party’s investment until each reaches an agreed-upon return on investment. If there is additional profit, the split can shift to where the managing partner (maybe a private equity firm in this scenario) gets a higher percentage of the profits (preferred return/carried interest). The $500,000 management fee identified above is taken out before the profit distributions are made.

3. More Revenue Across the Board

FSU highlighted certain cells in this spreadsheet to show where they expect an increase in future revenue. Note that they only get 50% of the Tucker Center “Lift” (new revenue). This is another indicator a third party is managing FSU’s efforts to maximize sports-related revenue. That third party is is likely getting 50% of the lift, in addition to a management fee and a preferred return on any investments.

4. Bonuses for Everyone! Where do I sign?

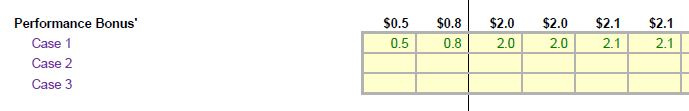

This is an excerpt from one of the spreadsheets. The first column is 2022 Actuals, and the final column is 2027 Estimated. A significant boost in projected performance bonuses could be a sales tactic by private equity firms - assuming these bonuses are going to the athletic department and university employees needed to approve the private equity partnership.

5. Turning Over Every Rock

In this email exchange between FSU’s advisor (JP Morgan) and FSU’s staff, a new revenue source is identified (and redacted).

This communication is from August 2023, nearly nine months into the project. That they are still in the due diligence phase and focused on minor expense categories like buildings and grounds tells me they are having difficulty finding the cash flow to support the hefty financial needs of a private equity firm/investor.

6. FSU staff gain protections when making risky investment decisions

Note #2 under the Summary of Changes. “Updated Prudence and Ethical Standards language to include procedures that protect University staff if adverse credit or market events occur.” In a cache of emails about making risky investment decisions, how odd is it to find staff changing university policies to protect themselves against risky investment decisions? That is a rhetorical question.

That is all for now. Let me know in the comments if you seen anything else of note.

Subscribe to this free newsletter and follow me on X at @BillFarleyPhD to get notified when my next article on Florida State’s efforts to exit the ACC is published.

Public Records Received February 8, 2024

hey Bill, I'm a journalist with a publication called the American Prospect. I'm working on a story about the reshuffling of college sports, private equity getting involved, and the future of student athlete payment. I was hoping to ask you a few questions. My email is lgoldstein@prospect.org.