FSU's ACC exit hinges on a bidding war

Up to ten financial institutions will soon bid on half a billion dollars in bonds

In the next few weeks, the athletic department at Florida State University is looking to borrow half a billion dollars to consolidate its old debt, renovate its stadium, and find a new home. Just like a family looking for a new house, annual income, credit ratings, and interest rates will determine who lends them money, how much they can borrow, and whether they can move into their new “dream home.”

Recent reports suggest FSU is considering a wide range of options to address a significant exit fee from their current home in the Atlantic Coast Conference. The most peculiar of these reports is tied to Project Osceola. As first reported by Sportico, Project Osceola is the moniker given to FSU’s exploration of partnerships with private equity firms. Private Equity firms are often seen as a last resort for private businesses needing financing because private equity firms expect high returns on their investments and a voice in management decisions. Could it be the exit fee from the ACC stretches FSU’s financial capacity to the brink? Is there a shotgun marriage to a private equity firm in the future?

Probably not.

FSU has a lot of experience financing large expenditures and the Athletic Department is in a solid financial position to borrow at a very low interest rate without ceding any management control to a third party. FSU’s discussions with private equity firms likely will narrow in the future to a possible limited partnership involving an investment in FSU’s licensing activities by a party with expertise to boost the brand value of the Athletic Department. There have been similar partnerships in recent years, particularly in minor-league baseball, that have proven beneficial for ownership groups and private equity firms.

How universities fund big purchases

Universities budget for significant one-time expenditures every year. These expenditures typically involve real estate purchases, building construction, equipment purchases, and on occasion, the acquisition of an operating business or paying a one-time fee to break a contract or settle litigation. Funding for these one-time expenses comes from a variety of sources.

Depending on the type and amount of the expenditure, the funding may include donations, grants, debt, cash reserves, or a combination of all four. When project funding requirements climb into the tens of millions and can be tied to an increase in revenue, revenue-backed bond debt is most often the funding mechanism of choice.

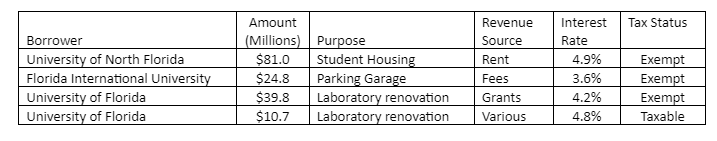

Borrowing money is second nature for universities. At the end of 2022 education-related debt in the State of Florida totaled $6.9 billion. Most of this debt (89%) is supported by tax revenues. The balance, or $774 million, is secured solely by the revenue-generating activities of the project that is financed. Examples of revenue-backed bonds added to the State of Florida’s debt portfolio in 2023 are displayed in Table 1.

Table 1: New Revenue Bonds in 2023 for Florida’s Public Universities

The interest rates for these bonds were set through a competitive bidding process involving multiple financial institutions. In the examples above, between seven and ten bidders submitted interest rate proposals. The interest rate bids for the different issues varied based on market conditions, whether investors had to pay taxes on the earned interest, and the perceived security of the revenue source attached to the project.

For example, a parking lot is viewed as a much better risk than student housing and therefore received a lower interest rate bid from proposers. The risk is lower for parking garages because there are significant barriers for competitors to build parking spaces convenient for students and faculty and there is substantial demand for any new parking spaces added to existing inventories – especially at a commuter campus like FIU. There are far fewer barriers for competing developers to build student housing within a reasonable distance of the campus, hence the higher perceived risk of the revenue source used to pay back those bonds and thus the higher interest rate.

How FSU can pay a large exit fee/settlement with the ACC

The conference exit fee and the grant-of-rights buyout for FSU to leave the ACC are generally estimated in the $400 to $500 million range without a settlement. A settlement might cut this total by half. Setting aside donations from boosters, there are three ways FSU can fund a significant part of the exit fees without resorting to high-interest loans or investments from private equity firms.

First, a significant portion of the exit fees could come from extra borrowing capacity generated by dropping interest rates. Over the past year, FSU’s athletic department, flush with positive cash flow, set in motion $503 million in projects that require bond financing. Resolutions approved by the State’s Division of Bond Finance in December 2023, identify two projects: $116 million for a new Football Operations Facility, and $265 million for renovations to the football stadium (e.g.., luxury boxes, premium seating areas, chairbacks for general seating areas).

In addition, the Division of Bond Finance received earlier authorization to refinance $122.4 million of existing debt held by one of the Athletic Department’s affiliates. With interest rates dropping, the Athletic Department will likely be able to borrow more money than it anticipated when the projects were approved last year. As an example, if the winning lender sets the average interest rate at 4.3% for this upcoming round of borrowing, and the estimated bond proceeds are based on an interest rate of 5.0%, the revenue pledged to the three bond issues could be stretched to finance additional bonds of approximately $40 million. These additional bond proceeds could be applied to the ACC exit costs.

Second, the bond resolutions authorizing the Athletic Department to issue $503 million in debt include a provision to issue additional bonds based on the availability of higher-than-anticipated revenues. The revenue sources pledged to the projects include “conference distributions.” Conference distributions are further defined as:

“(T)he annual gross revenue received by the University pursuant to its athletic teams’ competition in intercollegiate athletics conferences, associations, or leagues, including but not limited to the Atlantic Coast Conference (the “ACC”), any successor conference to the ACC, and any other conference(s) the University may join” (emphasis added).

If FSU exits the ACC and joins the Big 10, the Athletic Department has the option, based on the language in the authorizing documents, to issue additional revenue bonds using a portion of the higher media revenue received from the Big 10 (if granted a full share an estimated increase of $35 million per year). Using just $5 million of the additional Big 10 media revenue each year over 30 years could raise $75 million towards exit fees. Applying $10 million a year from the additional revenue could raise $150 million.

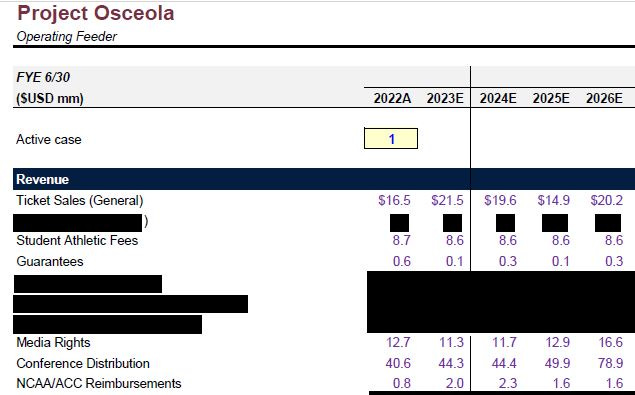

FSU is already counting on this lift in conference distributions. As part of Project Osceola, FSU is projecting that conference distributions will increase by over $38 million, from $40.6 million in 2022 to $78.9 million in 2026. FSU is silent on the rationale to estimate this higher revenue, other than a passing reference to CFB Playoff revenue.

Figure 1: Clipped image from a Project Osceola presentation

Finally, if FSU joins the Big 10 they could negotiate a provision found in agreements signed by the Universities of Oregon and Washington. Both of these universities can borrow up to $10 million each year against future media revenue. If FSU negotiates this same provision into its agreement with the Big 10, it would provide $50 million over the next five years to address exit costs. FSU could borrow against this revenue stream in its upcoming bond sale using a five-year term to raise an estimated $43 million immediately.

These three strategies together could raise as much as $223 million to fund a significant part of the exit fees or a settlement with the ACC – all without ceding ownership or control to a third party.

What to watch for in the coming weeks and months

There is a bidding war on the horizon that no one is talking about.

The State of Florida’s Division of Debt Finance will soon issue a request for bids to finance a minimum of $503 million for FSU’s Athletic Department. Expect up to ten financial institutions to compete for the opportunity to be the lender of choice for the Athletic Department.

Look for the following as the bid process unfolds:

Will the State seek bids before a settlement with the ACC? The interest rate risk associated with the borrowing could be affected by the stability of ACC. How much this impacts the interest rates is difficult to determine. Based on past timelines, the State should issue a request for bids by the end of February. If it is not issued in February, FSU likely received feedback from investors to hold back until a settlement.

What additional details are in the bid documents? The bid documents include additional details not found in the authorizing resolutions. These details may include flexibility for the Athletic Department to borrow additional funds, clarify if bond proceeds can be used for an exit fee, or provide alternative scenarios for bidders to consider (i.e., conference distributions from the ACC versus the Big 10).

What is in the missing Series B Bond Documents? The authorizing resolutions break the borrowings into three series (A, B & C). The resolution for Series A is for the football stadium renovation ($265 million), Series C is for the Football Operations Facility ($116 million), and the resolution for Series B is yet to be published. While likely a clerical oversight, when the document is made public look for any language that would increase the flexibility of FSU to borrow funds for the exit fees and the option to include a private equity partner in the management of licensing revenues. The primary purpose of the Schedule B bond should be the refinancing of existing debt ($122.4 million).

How long does it take for the State to publish the results of the bidding process? The results are typically published 30 to 45 days after the submission date for the bids. If the publication of results is delayed, the interest rates submitted by bidders could be higher than expected. This could cue another round of accusations by FSU against the ACC that the mismanagement of the conference is comprising the financial strength of its members.

Does the State come to the rescue? California, Tennessee, and Wisconsin state governments recently stepped in to help underwrite college athletic facilities. If the State of Florida steps in and backs the borrowing with tax funds the risk to investors drops dramatically as do the interest rates for the bonds. The extra borrowing capacity gained from this drop would make a significant contribution towards the exit fees.

Documents authorizing bond issues

Florida Division of Bond Finance approves issuing over $500 million in bonds (12/19/23)

Board of Governors approves Stadium renovation (11/9/23)

Resolution requesting Division of Bond Finance to refinance existing Athletic Department Debt (9/8/23)